Bank of Canada Cuts Policy Rate to 2.25%, Marking Second Straight Reduction

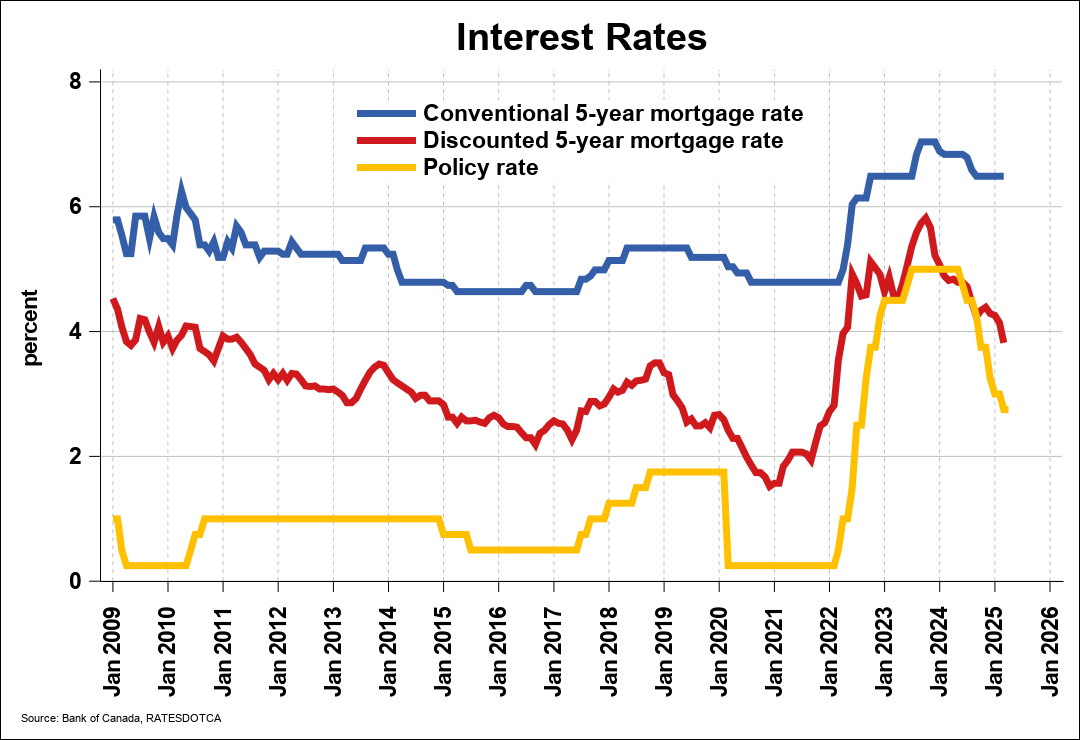

On Wednesday, October 29, 2025, the Bank of Canada lowered its target for the overnight lending rate to 2.25%, marking a second consecutive rate cut.

The Bank’s decision comes in the wake of a 1.6% contraction in Canada’s economy in the second quarter of 2025, due largely to a drop in exports and business investment. The Bank noted GDP growth will likely remain weak, at less than 1% over the second half of 2025, as U.S. tariffs and their surrounding uncertainty are weighing on key domestic sectors in Canada. However, the significant drop in exports that occurred in the second quarter is not expected to repeat.

In its October Monetary Policy Report, the Bank made note of an increase in residential investment, with both housing starts and resales up from the spring. However, the Bank also observed that “growth is held back by affordability challenges, limited availability of land and a persistent shortage of skilled workers in some regions.”

The Canadian job market continues to suffer losses in trade-sensitive sectors. Hiring remains weak, as does wage growth, the unemployment rate is at its highest level in more than four years, and highest since 2016 excluding the pandemic period.

Inflation has been trending within the Bank’s preferred range of 1 to 3% and the Bank expects inflation to remain near 2% through the end of 2027. Shelter prices remain elevated, while tariffs and their effects on the domestic economy continue to push costs up. On the downside, excess supply in the economy is anchoring prices and the removal of the consumer portion of the carbon tax will continue to act as a drag on inflation until next April.

In its rate announcement, the Bank suggested that its key policy rate will remain at its current level for the time being, if inflation and economic activity evolve in line with its expectations. This is its clearest messaging in some time on forward rate guidance—where the Bank is now is where it wants to stay—suggesting no additional relief going forward unless conditions materially worsen.

The Bank of Canada will make its next scheduled interest rate announcement on December 10, 2025. The Bank’s next Monetary Policy Report will be released on January 28, 2026.