Canadian Home Sales Begin 2026 on Ice as Snow Buries Central Canada

Monthly Housing Market Report

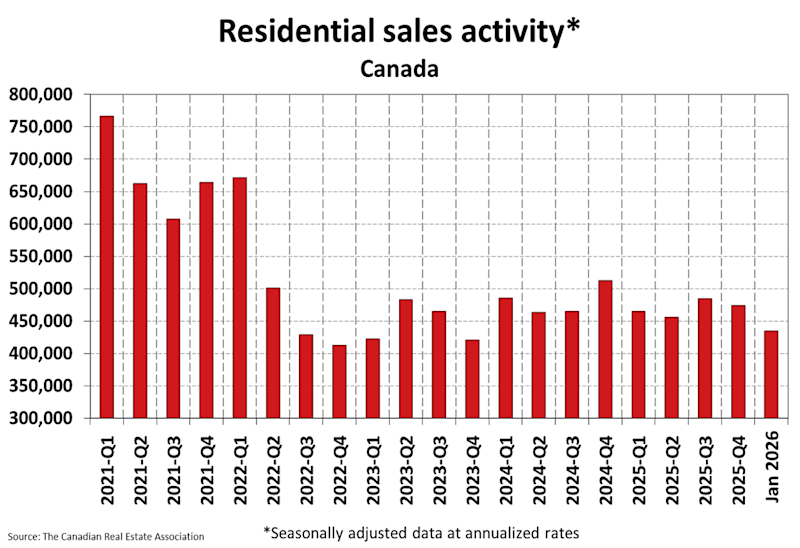

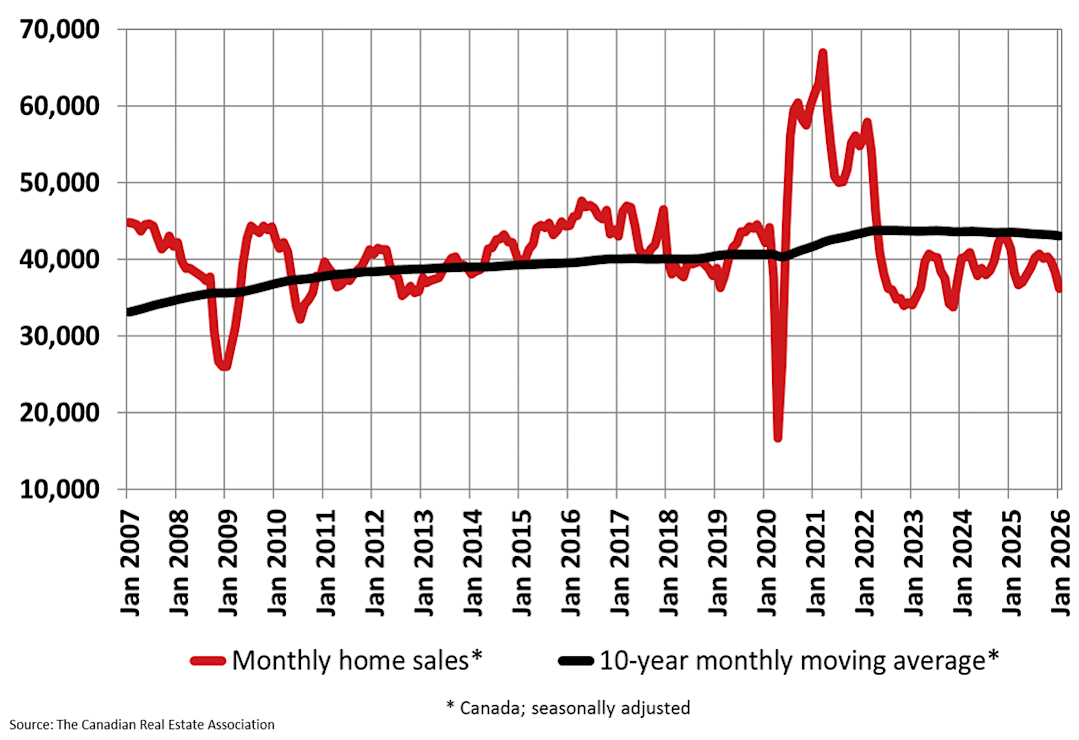

Ottawa, ON February 18, 2026 – The number of home sales recorded over Canadian MLS® Systems fell 5.8% on a month-over-month basis in January 2026. (Chart A)

“The monthly decline in national home sales was driven primarily by less activity in the Greater Golden Horseshoe and Southwestern Ontario, suggesting that the story was probably more about a historic winter storm than a downshift in demand,” said Shaun Cathcart, CREA’s Senior Economist. “Notwithstanding the chilly start to the year, we continue to expect 2026 will ultimately be defined by pent-up demand from first-time buyers finally seeing a chance to enter the market.”

January Highlights:

National home sales declined 5.8% month-over-month.

Actual (not seasonally adjusted) monthly activity came in 16.2% below January 2025.

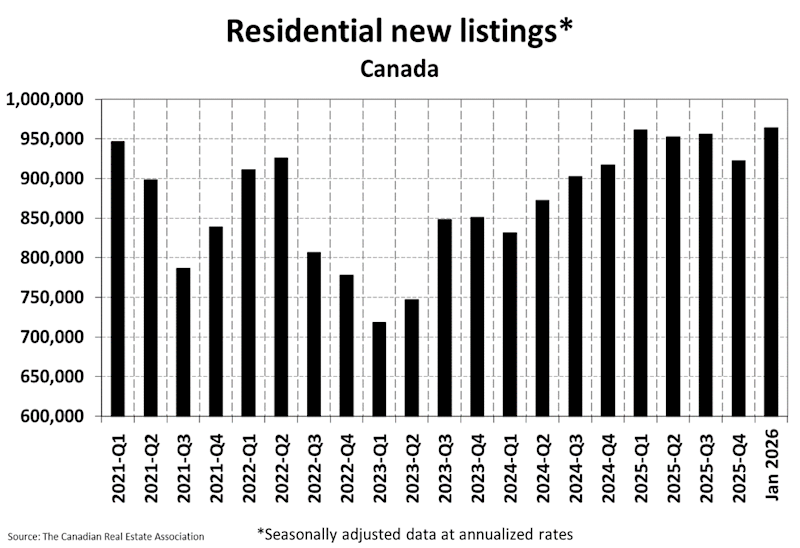

The number of newly listed properties jumped 7.3% on a month-over-month basis.

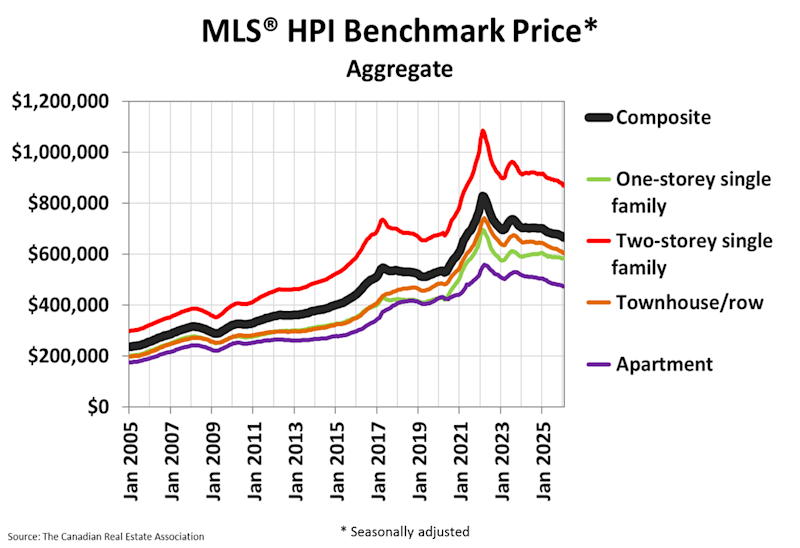

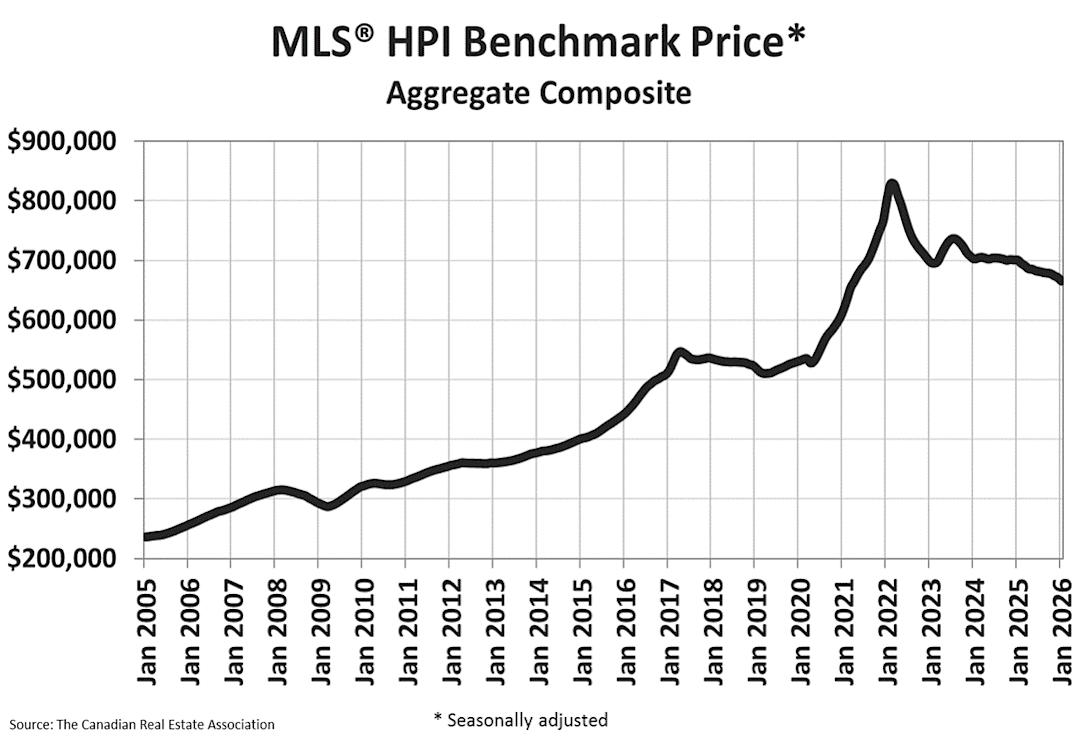

The MLS® Home Price Index (HPI) fell 0.9% month-over-month and was down 4.9% on a year-over-year basis.

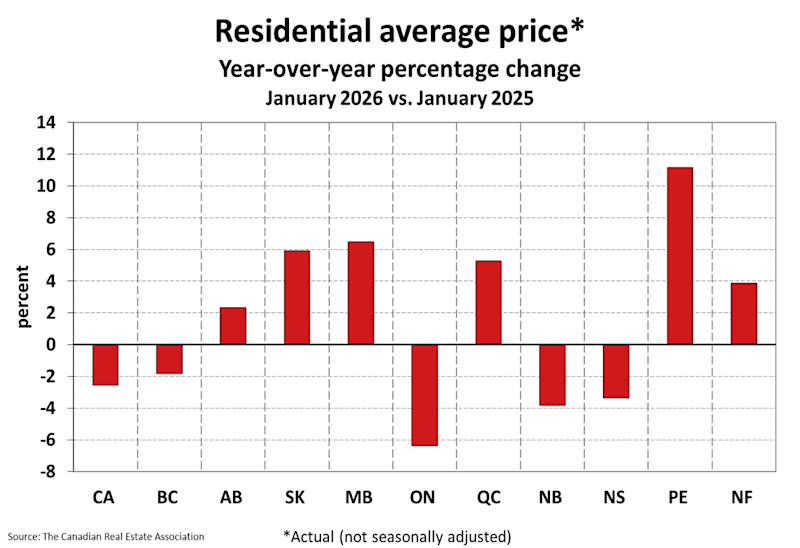

The actual (not seasonally adjusted) national average sale price dipped 2.6% on a year-over-year basis in January 2026.

Chart A

Similar to what happened in January 2025, new supply jumped on a month-over-month basis in January 2026, rising 7.3% as sellers seemed eager to get the year started.

The burst of new supply was driven by about two-thirds of local markets, and led by Montreal, Quebec City, Calgary, Greater Vancouver, and Victoria. Meanwhile, Central and Southwestern Ontario were far less prominent and, in many cases, recorded declines. This reinforces the view that winter weather was a primary factor in January in those regions, as it appears to have suppressed both demand and supply.

“We always say all real estate is local, and on occasion, including this January, that can mean the impact of local weather on the market,” said Valérie Paquin, CREA Chair. “In a repeat of 2025, new listings are showing up early to start the year, so sellers are eager to getting going, but we may have to wait a bit longer to see how buyers react. There’s still plenty of time to get ready to buy or sell this year, and you can get started by contacting a local REALTOR®.”

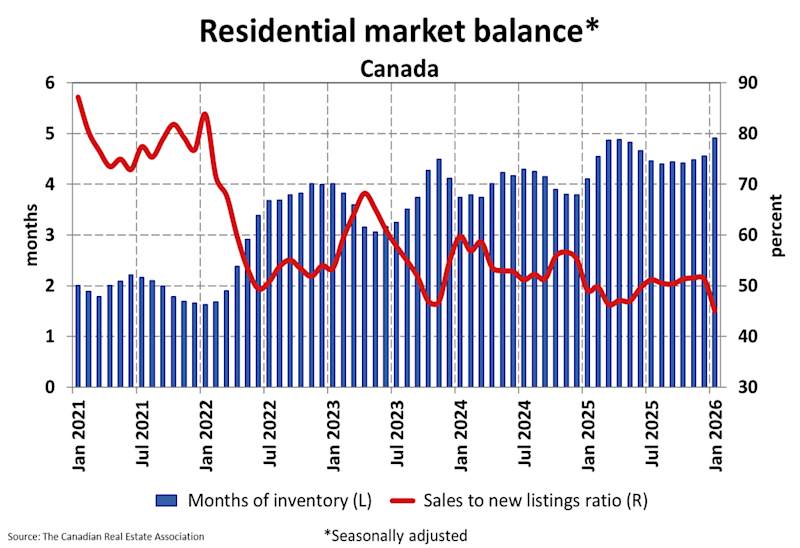

With a rare combination of a sizeable increase in new listings and a sharp slowdown in sales in January, the national sales-to-new listings ratio dropped to 45% compared to 51.3% at the end of 2025. The long-term average for the national sales-to-new listings ratio is 54.8%, with readings roughly between 45% and 65% generally consistent with balanced housing market conditions.

There were 140,680 properties listed for sale on all Canadian MLS® Systems at the end of January 2026, up 4.5% from a year earlier but 11.4% below the long-term average for that time of year.

There were 4.9 months of inventory on a national basis at the end of January 2026, up from 4.6 months at the end of December. The long-term average for this measure of market balance is five months of inventory. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

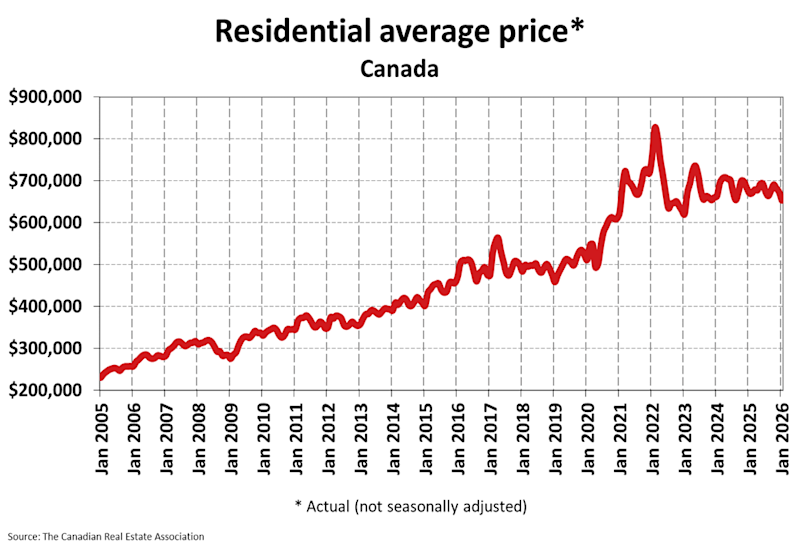

In line with more supply and less demand in January 2026, the National Composite MLS® Home Price Index (HPI) fell by 0.9% on a month-over-month basis.

The non-seasonally adjusted National Composite MLS® HPI was down 4.9% compared to January 2025. (Chart B)

Chart B

Regionally, prices remain down on a year-over-year basis in British Columbia, Alberta, and Ontario, offsetting gains in other provinces. An analysis by city shows the largest year-over-year declines dipping into double digits in Hamilton-Burlington and Oakville-Milton, contrasted by double-digit gains recorded in Sudbury, Quebec City, and St. John’s, Newfoundland.

The non-seasonally adjusted national average home price was $652,941 in January 2026, dipping 2.6% below the same time in 2025.

The next CREA statistics package will be published on Tuesday, March 17, 2026.